I don’t believe in dogma.

I don’t believe in dogma.

According to the Free Dictionary, dogma is “an authoritative principle, belief, or statement of ideas or opinion, especially one considered to be absolutely true.”

I think the key phrase here is absolutely true.

How can anything be absolutely true for everyone?

Through my experiences, and observing the experiences of others, I’ve learned that there isn’t just one absolute true way of believing or living your life. There are many ways.

This is definitely true when it comes to personal finance. When it comes to personal finance, I think the key word is personal.

It’s personal because it’s about your finances and not those of a business or organization, but it is also personal in that you get to choose how you handle your finances.

It’s about YOU and how YOU want to live your life.

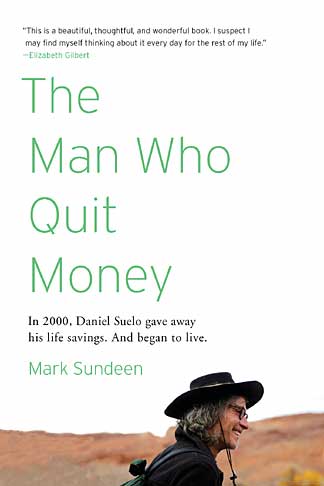

When I was in my mid-twenties and finally working full-time instead of being a full-time student, I read the book, Your Money or Your Life (YMOYL).

I was amazed that it had a plan for becoming financially independent (F.I. they called it) before retirement. I had never thought that becoming F.I. early–really early like in your 30s or 40s–was possible unless you were rich. It blew my mind!

So, I tried it.

I tracked all the money that I made and everything I spent money on. I recorded all my daily expenses into an Excel spreadsheet. Every month, I’d look at the various categories that I had spent money on (Rent, Food, Transportation, Utilities, Clothes, etc.) and for each category, I asked myself the following questions:

- Did I receive fulfillment, satisfaction and value in proportion to life energy spent?

- Is this expenditure of life energy in alignment with my values and life purpose?

- How might this expenditure change if I didn’t have to work for a living?

It opened my eyes to how I spent my money and how I could decide if what I spent was of value to me. And if it wasn’t, I could change it.

During the years that I was working towards being F.I., I met some people in their 30s who were F.I. through following YMOYL. Some had come from money and some had high-powered jobs where they made a lot of money. They did what the book said: they tracked their spending and cut back a lot; they saved a ton of money and invested it; they made enough interest to live off of; and then they quit their jobs.

(YMOYL also details stories of people who became F.I. who were schoolteachers and such and definitely did not come from money, but I’m just letting you know about the F.I. people that I met in Seattle during the 1990s.)

I don’t begrudge these F.I. folks their good fortune and their high-paying jobs. They chose to create a more frugal and more fulfilling lifestyle for themselves. That’s awesome.

But, could I relate to them? No.

I tracked my spending for about three years and it drove my former husband crazy. (Sorry, Erik!) After all the tracking and all the analysis, I could see that I didn’t spend much money. We lived in a one-bedroom condo with an extremely reasonable rent that included free laundry, free cable, free parking, and free utilities. I didn’t have a car and took the bus everywhere. I brought my lunch to work and treated myself to a lunch out once or twice a week. I spent little on clothes or shoes. I saved 10% of my income for retirement and a little less for savings.

I tried to cut my spending so I could save towards being F.I. After a while, it started to make me miserable. After a while, the daily and monthly tracking stressed me out.

So, I stopped.

Now, my personal finance routine is very simple.

I still use Excel but only to list out how much our monthly and annual fixed expenses are (mortgage, property tax, utilities, car insurance, health insurance, etc.). I revise it about twice a year. Marcus and I have agreed on a cash amount that feels reasonable for using on food, eating out, entertainment, and personal purchases. We withdraw that amount of cash each month, split it between us, and that’s all we use. We add to our savings every couple of months. We have no debt.

Are we fulfilled? Yes.

Are we on our way to being F.I.? Yes. Someday.

It’s been over fifteen years since I read Your Money or Your Life and there’s a new edition that is “revised and updated for the 21st Century.” I’ve added it to my library queue and am looking forward to reading it.

Do I think Your Money or Your Life is a form of dogma? Sure. But so is every other personal finance book out there.

To me the problem isn’t that there’s dogma being sold and marketed in our society; the problem is if you choose to follow it, and only it.

The great thing is that we, as humans, can choose what we want to believe and what we don’t want to believe.

We can try different ways of thinking. We are lucky to have that ability and it is truly a gift.

Experiment. Try. Adjust. Revise.

Find ways of managing your money that feels right, true, and good to YOU.

Follow

Follow