The best things in life are free. It’s not just some corny saying.

If you’re trying to be Super Frug, and your checkbook is hurting, I challenge you to spend one month doing The Best Things in Life are Free Challenge. For one month you can only pay money for the bare essentials: rent/mortgage, utilities, insurance, gasoline or bus/train fare, and groceries to provide three meals a day.

That means NOT spending money on eating out, lattes, treats, movie tickets, entertainment, magazines, books, cosmetics, haircuts, pedicures, etc.

If you’ve never been in a situation where you only had enough money for the essentials and nothing else, you will be in for a rude awakening. It will be hard.

Get past that. Breathe. Avoid shopping unless absolutely necessary. And with more free time on your hands, try some of the following…

– Watch the sun rise.

– Go for a walk in the park.

– Go to a free reading at the library or your local bookstore.

– Rediscover your local library.

– Go for a hike.

– Sit outside and listen to the birds.

– Work in your garden.

– Ride your bike or go rollerskating or rollerblading.

– Have a long conversation with a friend.

– Play your favorite music and dance!

– Play a card or board game with your family or friends.

– Make up a new recipe using only ingredients you have at home.

– Watch all your favorite movies that you already have on video or DVD.

– Watch the sun set.

I think you will be amazed at all the things you can do and enjoy that are free.

I feel very lucky that I live in a city that is filled to the rafters with free events. The Silver Fox and I scan our local newspaper’s calendar section every Friday for interesting happenings and we almost always find something fun and free to go to.

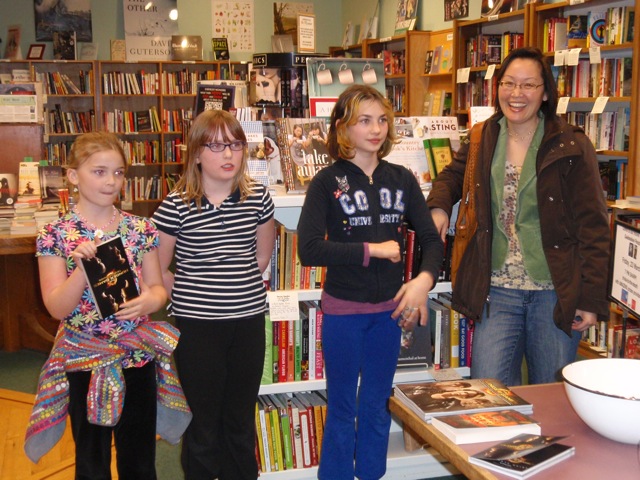

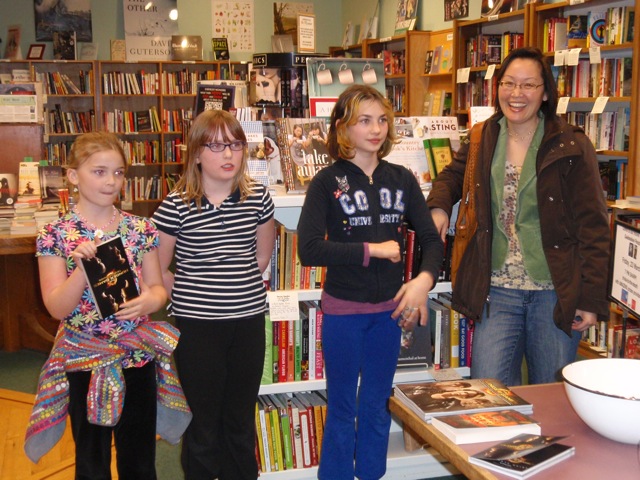

Last week, our local bookstore, The Secret Garden Bookshop, held a “reaping” in honor of the movie release of the crazy popular young adult book, The Hunger Games by Suzanne Collins.

Last week, our local bookstore, The Secret Garden Bookshop, held a “reaping” in honor of the movie release of the crazy popular young adult book, The Hunger Games by Suzanne Collins.

At the reaping, contestants (“Tributes”) compete to the death answering Hunger Games trivia questions. There was going to be cool prizes. We had to go.

Marcus and I thought we would both die early.

There was no way we could survive against the teens who had the read the book umpteen times. Each time I was called up to answer a question (you had to stand by yourself in front of the Question Queen), I would whisper, I’m not ready. I meant it. Somehow though, I squeaked through each round.

In the end, there was just four Tributes standing. As you can see in the photo at the top of this post, I am the oldest and the tallest. Marcus came in seventh. I got second place and was dubbed the “honorary Peeta.” I won a Hunger Games lunchbox and thermos. Cool.

That night, competing against people one-quarter my age, was more fun than I ever thought it could be. Everyone there was having a great time from the adults to the kids to the booksellers. We cheered every time someone answered a question right and we mourned every time someone “died.”

The beauty of it is we didn’t pay a dime for all this fun. It was totally free.

I hope you will try The Best Things in Life are Free Challenge. It can be hard but it can also be rewarding. Who knows? By the end of the month, you just might want to keep it going.

ps. Tributes in the Secret Garden Bookshop photos by Marcus Donner.

“Would you tell me, please, which way I ought to go from here?”

“Would you tell me, please, which way I ought to go from here?”

Follow

Follow