I read somewhere that Humphrey Bogart called it his f*ck you fund. Some call it an emergency fund. I call mine the compound.

I read somewhere that Humphrey Bogart called it his f*ck you fund. Some call it an emergency fund. I call mine the compound.

Whatever you choose to call it, it’s crucial to set up a special fund with money to survive on in case you lose your job, your partner loses his/her job, you absolutely can’t stand your job anymore and you quit (hence Bogart’s f*ck you fund), you have sudden health problems, etc.

With this special fund in place, you can worry less and enjoy your life more. Being Super Frug isn’t about deprivation, it’s about living well on less. You can’t live well if you’re worrying about how you’re going to pay for an emergency.

You’ve heard that old saying before: pay yourself first. That’s what it’s all about. Even if you have debts to pay off and can only save $20 from every paycheck, that’s fine. Start now.

Where to stash your cash?

Set it up in a savings account or a separate checking account. You want to be able to withdraw your money easily and quickly in case of a real emergency. The credit union that I bank at allows me to have as many savings accounts as I want, no charge.

How much should you save?

Some people say you should save enough to cover your basic needs (rent/mortgage, utilities, phone, groceries, health insurance, car insurance, gasoline, bus/train fare, etc.) for 3 months. Others say 6 months. Some say a year. I’m paranoid about stuff like this so I aim for a year’s worth. Everyone is different. Choose the number of months that sounds right for you.

Why do it?

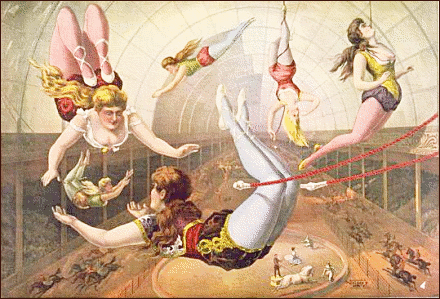

We all need a cushion in case of emergencies and major life changes. With it, you will feel taken care of and confident in your daily interactions with money. Without it, it’s like performing a trapeze act without a net. You could lose all that you’ve worked hard for. Don’t wait. Create your safety net today.

Follow

Follow

Pingback: Why I save money | Super Frug

Pingback: Why I save money | Super Frug