Being frugal isn’t about not spending money; it’s about spending money according to your values.

Being frugal isn’t about not spending money; it’s about spending money according to your values.

Or as Marjorie Harris, author of Thrifty, says, “Being thrifty requires a brain; being cheap doesn’t.”

I’m frugal, but I’m not cheap. I will gladly pay money for things and experiences that match my values and that I will really enjoy. To do that, I’ve had to think carefully over what I really value in life.

When I first started my Super Frug lifestyle, I made a list of things I like spending money on and things I don’t like spending money on. Today, we will focus just on the likes.

Here’s what I like to spend my money on.

1. Mortgage

I love our house and I love our neighborhood. I want to live in this house until I die–which I hope is a long time from now. We took advantage of the great interest rates and refinanced twice in the last four years and now our mortgage is very affordable.

2. Utilities

I don’t know about you but I like having clean water, regular heat and electricity, gas for my stove, and the garbage and recycling taken away every week. I love that the city of Seattle composts! I’m looping in my mobile phone, land line, and Internet service under this category too. It may sound boring but I greatly value my utilities and I’m glad they are readily available and generally, reasonably priced.

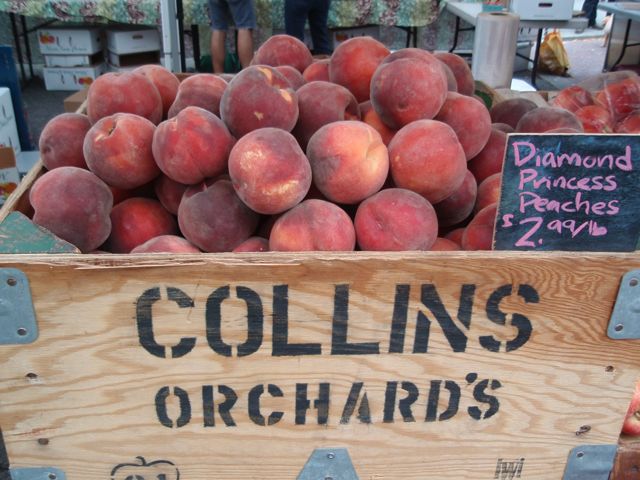

3. Good, fresh food

3. Good, fresh food

Good food leads to good health and happiness. I’m happy to spend money on good food. I’m also lucky to live in a city where fresh food is readily available and reasonably priced. Marcus and I are able to buy all the fresh fruit and vegetables (mostly regular rather than organic), meat (sustainably raised only), seafood (wild only), nuts, grains, and a few processed foods that we need for about $200-$275 a month.

4. Haircuts by Jamie L. Scott!

My stylist and I always greet each other by calling out our respective full names. “Hello, Jamie L. Scott!” “Hello, Peg Cheng!” I love getting my hair cut and styled by Jamie at her salon CERES. She charges me $50 for my haircut and I give her a $10 tip. I know for some people, $60 for a haircut sounds like a lot, but again, being frugal is about spending money on what you value. I really value my time with Jamie and she always makes my hair look great, so paying $60 feels just fine to me.

5. Health club membership

This year, I joined a Tai Chi and Qi Gong dojo called Embrace the Moon. I’m taking classes twice a week and even though it costs three times more than my old gym membership, it’s totally worth it to me. It’s a great space with wonderful teachers and great students, and I’m learning an ancient practice that’s improving my mental and physical health every week. I feel that the money I’m spending now on Qi Gong and Tai Chi classes will save me thousands of dollars later when I have less (or no) health issues in my old age.

6. Travel

Marcus and I both love to travel! Over the past five years, we’ve developed better and better skills at traveling light and for less money. We love to experience and learn about new places, foods, cultures, art, architecture and people. Our goal is to travel to at least one international destination every other year and to U.S. destinations three times a year.

7. The Arts

This is a very broad category but for me it includes movies, plays, concerts, dance performances, museums, readings (usually free!), and lectures or talks by authors, artists, musicians and other creative beings. Because I want to go to many art events, I hunt down good buys such as pay-what-you-can nights and free events.

8. Art

This is one category where I don’t try to get a “good deal.” I admire people who are trying to make a living as an artist and I support them by paying the price they set for their art.

9. Excellent restaurants

If I love a restaurant’s food and service, I will come back again and again. While most of the places Marcus and I frequent are what we call excellent ethnic eats on the cheap, some restaurants we enjoy are more expensive and so we try to patronize them on special occasions like birthdays and anniversaries.

10. Exquisitely made, perfectly fitting shoes and boots

Need I say more?

Now that you know what I like spending my cold, hard cash on; what do you like spending money on?

Making a list is a great exercise for getting a grip on what you really value in life. I hope you’ll try it. Let me know what you discover!

Follow

Follow